The UK Registration System

A rebuttal to those that think restored classics are not ecologically sound, from a pal's car in America.

Links to DVLA and DVSA (was VOSA) sites including email contact points, obtaining vehicle registration, tax and MOT info, what you should do if you rebody your MGB, UK registration plate info, cherished numbers, registration plate info for other countries, and international country ovals.

August 2025: The DVLA has announced updated registration policies for registering repaired, restored and modified vehicles that will come into effect from Tuesday 26 August. The process seems to have been simplified and means that vehicles that have been subject to significant structural modifications or converted to electric will be able to keep their original identity, with notification to the DVLA.

August 2024:The FBHVC is calling for a one-off safety-check for vehicles that have undergone major renovation or modifications. Amongst its recommendations are:

If it isn't already (all MGBs should have been eligible from 1st April 2021) you can register your car in the Historic Vehicle class and benefit from zero road tax, DVLA document INF34 applies. Note that you do not have to do this to be exempt from obtaining an MOT, that is automatic once the car is 40 years old. The DVLA and the registration documents only record the date of first registration (but see below), which can be months after the date of manufacture. If the first registration date is from 1st of January to 7th January then the DVLA will assume it was manufactured in the previous year and require no further dating evidence, otherwise you will need a BMIHT Heritage certificate as minimum evidence - note that dating letters are no longer accepted. Post Offices that handle vehicle tax should be able to process the application, but you may need to take the above DVLA document with you as they are quite likely to say 'computer says no' without it, and indications are that they won't do it anyway. Otherwise you will have to send the application to the DVLA - always send it 'Signed For' to cover the costs of losses, which do occur.

June 2021: The DVLA Vehicle Enquiry Service will list the date of first registration and the date of manufacture of any vehicle. However it is assumed that the year of manufacture is the same as the year of first registration (unless first registered before 7th January), which isn't always the case of course. Hence the need for the above dating document when applying for Historic status if your vehicle was built before 7th January and the 40th anniversary of manufacture has now come round. It's only when you have successfully re-registered in the Historic class that Date of Manufacture will show the correct year.

How Many Left - a database of MGBs taxed and on SORN year by year culled from DVLA data.

As an adjunct to the two previous paragraphs a question cropped up on the MGOC MGB technical forum regarding moving to the Historic Vehicle class, and the fact that the DfT information sheet INF34 says you will need: "A vehicle registration certificate (V5C) - that clearly shows the vehicle was made, or first registered, before 1 January 40 years ago." Did you know that the V5C might show the manufactured date? Neither did I, and my V5Cs only show the 'first registered' date. But the How Many Left web site does have DVLA data ordered by date of manufacture. If you select a particular model, then 'Years' there are tabs for both dates. Selecting 'first registration' displays the appropriate table, and below that is a link to 'More info'. Scrolling down to 'Where does the data come from?' lists a set of tables published by the DfT, extracted from the DVLA database, and below that list is another link 'You can download the original data here'. Scroll down that page to Collections and select Vehicles, then the top entry All vehicles (VEH01). Select 'VEH0124: Licensed vehicles by make and model and year of first registration: United Kingdom' and it will download to your computer, then select and download 'VEH0126: Licensed vehicles by make and model and year of manufacture: United Kingdom'. These are ODS files constructed in 2019 in Apache Open Office format, which cannot be opened in Excel if you use Microsoft products. However using an online converter such as Zamzar you can convert and download (maximum of two files per day without registering) in Excel format, then browse to your hearts content. They are large files containing data for all vehicle types, manufacturers and models over several tabs. Delete all the tabs except the first ('Cars') and last ('Others'). Still all manufactures and models, but by deleting all the rows you are NOT interested in and saving the file with another name makes the files more manageable.

You now have a two files showing how many vehicles were first registered, and when they were manufactured, year by year, based on the data held by the DVLA in 2019, and can compare the two. I looked at MGB GT V8 as a) I have one and b) there were a relatively small number manufactured/registered so easy so compare. At the end of each row there are two extra columns - 'unknown' and 'total', and those two make interesting reading:

Replacing number plates? Something to bear in mind.

Guidance on preparing for an MOT, and the extension of MOT exemption to cars more than 40 years old as of 20th May 2018.

July 2019: Still confusion on the MGOC forum over changing the tax classification to Historic despite several articles and explanations in Enjoying MG from Roger Parker. Someone with a build date of 8th February 1979 is trying to change the classification, but the rule is that only when the car is in it's 41st year on the 1st January can it be changed, and even then only on or after 1st April that year. So that car can only be changed on or after 1st April 2020. Had it been built one month or more earlier (cars first registered before 8th January are assumed to have been built before 1st January) it could have been changed on or after 1st April 2019. That is to benefit from free road tax, exemption from MOT is automatic immediately the car reaches its 40th birthday, i.e. 8th February 2019 in this case. At the next tax renewal (regardless of whether the tax is paid for or zero-rated) if an MOT is still in force renewal will proceed exactly as before. But if the MOT has expired you will be asked to make a declaration that the vehicle is not substantially modified. If you do not make that declaration the renewal will not proceed.

May 2018: From 20th May 2018 cars over 40 years old are automatically considered to be exempt from an MOT as Vehicles of Historic Interest (VHIs). At each tax renewal period a check will be made to see if there is a current MOT and if there is the tax will be renewed as normal. However if there is no current MOT then when applying online you will be asked to make a declaration that the car is not substantially changed, and on doing so the tax well be renewed. If you don't make that declaration the tax will not renewed and you will not be able to keep or use the car on a public highway. If renewing at a Post Office and there is no current MOT you will have to provide completed declaration form V112 before the tax will be renewed. Note that if you stop having MOTs there is quite likely to be a gap between the last MOT expiring and the next tax renewal, during which you will not have an MOT and neither will you have made a declaration. I'm assured by the DVLA that this does not constitute an offence. Even if you declare VHI you can still choose to have an MOT and the results will be recorded as normal, and regardless of whether you have an MOT or not the vehicle must be fully roadworthy at all times while on a public highway.

The situation regarding changing the taxation class to 'Historic' to benefit from free Vehicle Tax has not changed, and is separate to declaring VHI: Cars manufactured before 1st January 1976 have been eligible since 1st April 2016. More detail here. For cars manufactured during 1976 and each subsequent year thereafter see here. Bear in mind that it is manufacture date that is important, and these cars could have been around for a couple of months or more before purchase and registration (September 72 to June 73 in the case of my roadster). When these dates are in different years then unless the first registration date was 7th January or earlier you will need dating evidence.

Latest info on 'black and silver' number plates - basically once a car is classed as 'Historic' it can carry them.

January 2018 - Eight-point test to be ended for 'substantially modified' cars, and first MOT test to be kept at three years.

September 2017 - MOT reminder or a £1000 fine?

And whilst on the subject of MOTs, local Councils operate MOT testing stations that are open to the public. They usually don't do repairs so have no vested interest in failing your car. However I checked with the one nearest to me (Coventry) and the test fee is the full £45, whereas many 'conventional' testing stations will charge a reduced fee, such as £29.95 at Halfords in Solihull. Having dealt with that branch for many years with three cars I have never had any doubts about any defects or advisories they have raised.

April 1st 2016 - Vee goes Tax Free.

Budget March 2016.

March 2016.

The first response started off OK saying I wouldn't be able to change the class until 1st April 2016 as expected, but the remainder of the email referred to the vehicle as needing to be manufactured before 1st January 1975, not 1976. A phone call wasn't much better. Initially he said I would have to wait for the Budget to state that the concession had been rolled forwards one year. However the Finance Act 2015 i.e. last year's Budget has already stated that vehicles constructed before 1st January 1976 will be eligible from 1st April 2016. He then changed his tune and said to go to a PO on 1st April with the amended V5C and apply to retax. If they say there is no fee then all well and good, and to send off the V5C to the DVLA. But if they still want the fee then go back again the next day. If they still want a fee then get back to the DVLA. Asked if I would need to SORN it before the end of March he said no, but if I can't get it retaxed in the first couple of days then I'll probably have to. A second email reply from the DVLA apologised for and corrected the error in the first reply, but after four different responses from them who is to say that this last one will work out in practice?

You can apply in person at a Post Office® that deals with vehicle tax. The V5C must show a date of registration prior to the 01.01.1976.

The following documentation will need to be submitted:

The keeper will need to write 'Historic' in the change to taxation class field in section 7 of the V5C and sign section 8.

An updated V5C will be returned within 4 weeks.

January 2016 - another fine DVLA mess.

January 2016 - DVLA info on Historic Class changes.

Previously INF34 said:

However this response from the DVLA received on 30th November 2015 said:

If this is not recorded on the V5C but the vehicle was manufactured prior to this date you will need to produce dating evidence and submit the application to DVLA, Swansea, SA99 1DZ.

Acceptable dating evidence can be obtained from:

While that sounds pretty stringent it wants any new rules to replace the 'complete mystery' of DVLA decisions relating to imported or highly modified cars 'with owners being slapped with Q-plates for as small changes as drilling a hole'. Full story here.

MGB GT V8 1977 1976 1975 1974 1973 1972 Unknown age Total

Year of first registration 2 78 169 275 137 0 26 692

Year of manufacture 1 71 149 126 84 3 255 692

*A certified copy of the factory record (with the embedded stamp) will be acceptable only from the British Motor Industry Heritage Trust (The British Motor Museum)

So an improvement in that you can do it at a Post Office if the date of first registration is in the qualifying year, otherwise it has to be done through Swansea. Even doing it at a Post Office you still have to send off the amended V5C to Swansea for reissue. Does not mention the extension of the qualifying period to 7th January as in the then current INF34.

Now INF34 (dated 18th November 2015) says:

You will need:

- A Vehicle registration certificate (V5C) - this must clearly show that the vehicle was made or first registered before 1 January 1975. If you do not have a V5C, or if you think the age shown is incorrect, you will need to produce an extract from the manufacturer/factory record or an extract from the appropriate ‘Glasses Check Book'. Dating certificates from a vehicle enthusiasts' club are not acceptable to change the date of manufacture for an already registered vehicle.

(If the V5C indicates that the vehicle was registered from 1 January 1975 up to and including 7 January 1975, we will let you register it as a historic vehicle, based on the assumption that the vehicle would have been made in the previous year).So on the face of it a further improvement in that you can now do it at a Post Office even if the date of first registration is outside the qualifying year but the date of manufacture is inside, but what does '... if you think the age shown is incorrect ...' mean? Also it talks in terms of the V5C showing the date the vehicle was made or first registered, and dating evidence being needed to 'change the change the date of manufacture for an already registered vehicle.', as if V5Cs can now show date of manufacture.

I'll repeat that only the new-style The British Motor Museum certificate is acceptable as dating evidence. This has a large gold The British Motor Museum logo impressed into the lower right-hand corner of the certificate, issued from September 2001. The older certificate with the small The British Motor Museum logo in the centre at the top is not acceptable. If you have an old certificate it will cost £24 to replace it with a new-style, you will have to supply a valid Heritage Certificate number, or a copy of the old Certificate. If your certificate was issued before 2001, it will not appear on The British Motor Museum database so you will need to email a scan to The British Motor Museum.

I'll also repeat the advisability of sending documents to the DVLA by Royal Mail Signed For at least if not Special Delivery Guaranteed, due to the risks of significant fines if the documents go astray.

It remains to be seen what happens when Vees paid-for tax expires on 31st March this year, and she becomes eligible for Historic status on 1st April. I'll try getting the class changed and the road tax renewed at a Post Office a couple of weeks prior to that (although what one gets back as evidence now no charge is made or paper disc issued remains to be seen), but Roger Parker writes that he has known of people having everything done at their Post Office including sending the V5C off to Swansea at one extreme, to the other where they wouldn't even renew the tax even though they was no class change. 'Plus ca change', as they say, and I may have to SORN her for a while.

December 2015 - a snippet on buying and taxing a car.

As well as having to tax it before you can drive or keep it on the public highway - and that includes driving it away from the seller - you also need insurance of course. When retaxing a car you already own online it tells you it has checked the insurance and MOT database. But with a new car you may only have insured it a day or so before, and it takes time for the insurance company to get the details onto the DVLA database, which would seem to be a show-stopper. However following proposals in 2012 the DVLA no longer check for insurance when retaxing a car online or at a Post Office, only for an MOT. They do however use the Motor Insurance Database to check that a car with road tax is continuously insured. November 2015 - Historic taxation class and 'black and white (or silver)' number plates.

An unintended consequence of the 2001 change bringing the cut-off date for black and white number plates into line with that for eligibility for Historic status, was that now the Historic status is being advanced year by year again the eligibility to 'wear' black and white number plates was also advancing. But the rules changed again on 1st January 2021 preventing cars built from 1st January 1980 ever wearing black and white plates even when they move into the Historic taxation class. It's all very confusing, but for the last two years the Finance Bill has contained a clause stating that the Historic Class ('exempt vehicles') will be advanced by one year, although it doesn't come into force until April 1st the following year. For example the Finance Act 2015 Part 2 Section 59 states:

59 VED: extension of old vehicles exemption from 1 April 2016 In other words vehicles manufactured during 1975 will be eligible for Historic status and hence free road tax, but not until 1st April 2016.(1) In Schedule 2 to VERA 1994 (exempt vehicles) in paragraph 1A(1) (exemption for old vehicles) for the words from "constructed" to the end substitute "constructed before 1 January 1976".

(2) The amendment made by subsection (1) comes into force on 1 April 2016; but nothing in that subsection has the effect that a nil licence is required to be in force in respect of a vehicle while a vehicle licence is in force in respect of it.

The second part of subsection 2 has caused some confusion, but I think all it means is that as long as you have paid road tax still in force at 1st April you don't have to apply to change the Taxation class to Historic immediately if you don't want to.

However this DVLA document on black and silver plates states:

The 40 year exemption date rolls forward automatically each year on 1 April. This is not borne out by the Finance Act, which must take precedence. If for any reason a future Finance Bill did not contain the clause equivalent to Section 59 above, then it would not happen - unless other steps had been taken to make it rolling and automatic. Also this response from the DVLA dated 1st December 2015 states "Legislation was also introduced to exempt vehicles manufactured prior to 1 Jan 1975 from the payment of vehicle tax. This will come into force on 1 April 2015. The intention from HM Treasury is to introduce a legislative clause every year so that vehicles manufactured 40 years ago will become exempt from vehicle tax." which confirms that it is not automatically rolling but must be introduced each year.The remainder of this update has been replaced by January 2016 above.

July 2015.

With not one but two pals putting MGBs back on the road the question of what one does about SORN, MOT and Road Tax came up. You can't tax it until you have an MOT, which usually means driving it to a test centre. But if it's on SORN it's illegal to have it on a public road and it may be picked up by ANPR. But if you take it off SORN to take it for an MOT it may also be picked up by ANPR as being untaxed. Browsing t'interweb showed others with the same question, and no answers, not even from the DVLA. However I've not been able to find any way of taking a car off SORN, short of retaxing it (or selling it or scrapping it and sending the destruction documentation to the DVLA). So the only way seems to be to get the MOT while on SORN, then when that is successful tax it in the normal way. The important thing is to book the MOT in advance, and make sure they have the registration recorded correctly, so hopefully you would be able argue the case if you were picked up by ANPR. While investigating this, as well as legally being allowed to take the car for a pre-booked MOT without being taxed, some sources indicated that it is also legal to take it for pre-booked repair prior to an MOT, although not this GOV.UK page. What to do if the repair is completed but it still doesn't get an MOT and you need to get it back home again isn't mentioned. Of course you must have insurance in place for any use on a public road, but that can be obtained independently of anything else. It's also worthwhile reminding readers that if you trailer an untaxed car anywhere, regardless of whether it is on SORN or not (i.e. it was taken off the road prior to 31st January 1998), remember to cover up or remove number plates as they can still be picked up by ANPR, which don't take photos, and you will get done ... unless you can show you were taking it for a pre-booked MOT or repair! Incidentally once made SORN is now continuous, it doesn't have to be renewed annually.

May 2015.

Yet another DVLA dodge to make more money out of you has come to light. When selling a car, the DVLA only base the refund of any unused tax from the date they receive the notification from you. If you sell your car at the end of the month in order to get the most out of the tax, and they receive the notification on the 1st of the next month or later, then because they only refund complete months, you will lose all of that following month. So make sure you complete the transfer and get the notification off to the DVLA to arrive before the end of the month in which you sell the car. February 2015.

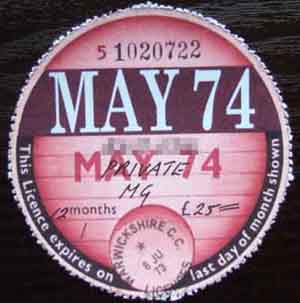

With there being no requirement to display a valid tax disc after September, it occurred to me that it might be nice to display the 'original' disc instead. Reproductions of historic formats have been available for a long time, for display purposes, which never interested me. But in December I did some research, and opted for Greg Powell based on price, options, and less subjective things like the web site, and not least that payment is on receipt when you are happy with the result. I sent in my request, but he was so snowed under he asked me to re-apply at the end of January. This I did and in a few days I got my discs (three i.e. two spares, as well as a lifetime warranty for replacement should they get damaged by water, fading etc.) and very happy with them I am too, I immediately ordered a set for the V8. No perforations as supplied, but you can see the positions, and a couple of minutes with a darning needle with a rubber (eraser!) behind the disc soon solved that. Folded the surround over at the new perforations, and the two parted, leaving a ragged edge just like the originals! And just so it doesn't feel left out I shall do the same for the ZS as well, but I already have the actual original for that, which came to me with the car.

With there being no requirement to display a valid tax disc after September, it occurred to me that it might be nice to display the 'original' disc instead. Reproductions of historic formats have been available for a long time, for display purposes, which never interested me. But in December I did some research, and opted for Greg Powell based on price, options, and less subjective things like the web site, and not least that payment is on receipt when you are happy with the result. I sent in my request, but he was so snowed under he asked me to re-apply at the end of January. This I did and in a few days I got my discs (three i.e. two spares, as well as a lifetime warranty for replacement should they get damaged by water, fading etc.) and very happy with them I am too, I immediately ordered a set for the V8. No perforations as supplied, but you can see the positions, and a couple of minutes with a darning needle with a rubber (eraser!) behind the disc soon solved that. Folded the surround over at the new perforations, and the two parted, leaving a ragged edge just like the originals! And just so it doesn't feel left out I shall do the same for the ZS as well, but I already have the actual original for that, which came to me with the car.

August 2014, updated October 2014.

The end of the tax disc is almost upon us - from the end of September. Fine if you are keeping a car, but what about buying/selling? Legally speaking the existing car tax is cancelled (but see below) the moment ownership changes hands, i.e. you swap the payment for the keys, and therefore the new owner can't use or keep the car on the public highway until they have bought their own road tax. Failure to follow the new rules could result in a £1000 fine. It's all explained in this DVLA video - or maybe not, this has to be the crassest piece of government information of all time.

Perhaps you pay for the car but have to leave it with the previous owner until your new V5C comes through, 2 to 4 weeks, as that is needed to tax it? Surely not!

If the car is currently taxed and not on SORN you could drive it away without the rozzers or ANPR picking you up - but I wouldn't put it past them to retrospectively see if the car had been picked up on any ANPR cameras between the seller saying he sold it and you buying a new tax disc. The Telegraph says "Under the new rules, car sellers must tell the Driver and Vehicle Licensing Agency (DVLA) immediately of the change of ownership, and the new owner must register to pay tax before driving the car away." Immediately? The requirement is to post back portions of the V5C, which is hardly 'immediate'. What does 'register to pay tax' mean? Is that something less than paying up there and then? The AA is slightly different with "you will have to get new vehicle tax yourself before you can use the vehicle", does that include before driving it home after purchase?

As well as having to tax it before you can drive or keep it on the public highway - and that includes driving it away from the seller - you also need insurance of course. When retaxing a car you already own online it tells you it has checked the insurance and MOT database. But with a new car you may only have insured it a day or so before, and it takes time for the insurance company to get the details onto the DVLA database, which would seem to be a show-stopper. However following proposals in 2012 the DVLA no longer check for insurance when retaxing a car online or at a Post Office, only for an MOT. They do however use the Motor Insurance Database to check that a car with road tax is continuously insured.

The AA section also includes a link to a new DVLA online tax-disc renewal service, but just like the existing system that only allows you to purchase a new tax disc if the existing V5C is in the purchasers name, which it won't be! October: This services does now include an option for those just having purchased a vehicle. But the page says it is a 'Beta' service i.e. still under test. The page offers a link to the original service, which also now appears to cater for those having just purchased a vehicle, but at the time of writing that service is 'currently unavailable', and it routes you back to the new service. However it is a different page, which doesn't include the new purchaser option. But if you persevere you do then get to the page that caters for new purchasers! End of update.

You can phone - lines apparently available 24/7 but you will be at the mercy of answering delays - while you are at the sellers premises having paid over your money: Telephone: 0300 123 4321; Textphone: 0300 790 6201.

You can also renew it at a Post Office, but would have to wander off to find one, having left both car and money with the seller? I don't think so. You can't even legally leave it parked outside his premises, having paid up and got the keys, while you find a Post Office. Also the DVLA page says to do it at a Post Office you need either the V11 reminder or the V5C, which a new purchaser won't have, as well as the MOT.

And how about when you phone or go to the Post Office and they tell you there is some kind of problem and you will be unable to tax it in your name, having already handed over the money? You will have to go part way through the process beforehand to confirm that you will be able to tax it in your name before handing over the money, then complete the sale/purchase, then complete the process of taxing it in your name.

Maybe the seller should drive you to the Post Office, you tax it in your name, and only then hand over the money, then drive them back home!

The only other option is trailering it away from the seller, but make sure you cover up the number plates, as ANPR cameras won't know the difference between being on the road and being on a trailer. Towing is probably out as the vehicle is still 'on the public highway', and if you can't park it I don't see how they will allow you to tow it. Even then you will have to SORN it at the time of purchase.

Once you have agreed with the seller how it is to be done, the seller gives parts 10 to 12 of the V5C to the purchaser, and sends the rest off to the DVLA. The purchaser keeps part 10 (V5C/2) and sends part 11 off to the DVLA in order to get a new V5C. It looks like the purchaser can use the V5C/2 to tax the car once, at the time of purchase, using one of the above options with the V5C/2 document reference number and the registration number. Hopefully this will ensure you give the right details and don't tax someone else's car! Note that you won't get a new V5C until 2 to 4 weeks after the seller has returned his parts of the old V5C, and they have been received and processed by the DVLA. If that doesn't happen you won't get a new V5C, even though you have sent in part 11 of the old one, and after 4 weeks you will have to submit form V62.

The DVLA only refund full month portions of the old tax disc (automatic when the seller sends in his parts of the old V5C) i.e. starting from the 1st of the next month, but the buyer will have to tax it from the 1st of the current month. So either the seller loses a month bar one day (transferred on the 1st of the month), or the buyer loses a month bar one day (transferred on the last day of the month, but see the 'Gotcha' for the seller with this), or something in between, which means the DVLA will always trouser a months tax every time a car changes hands, that's up to 7 million times a year - a nice little earner! The purchaser could buy it near the end of the month, and not re tax it until the 1st day of the next month, but that leaves a gap in the 'continuous taxation' that the purchaser will be liable for. Which leaves SORNing it at purchase, trailering it home, then taxing it at the beginning of a subsequent month.

March 2014

Good news, the Chancellor has seen fit to reinstate the rolling tax exemption for classic cars. From 1st April 2014 cars built during 1973 will be eligible for classic status and zero-rated VED or 'tax disc'. Then from 1st April 2015 the exemption will become rolling, i.e. cars built during 1974 will become eligible, and so-on. Page A84 of the Treasury Overview of Legislation and Tax rates for 2014-'15. Still two more years for Vee. December 2013

The issuing of road tax discs is to end in October 2014. Makes it cheaper for the DVLA, but anybody in a collision won't be able to check the tax disc of the other vehicle exists and relates to the vehicle in question. Having one is no guarantee that the vehicle is insured, or even that it is a genuine disc, but now we will have nothing. The recommendation is to write down the chassis number of the vehicle, usually visible through the windscreen on more modern cars, but then other sources say to cover it up as it makes it easier for thieves to clone your vehicle! This (ending of tax discs) is going to make cloning easier, as all the cloner will need is the number plate of another vehicle, and it won't even need to be the same colour, model, or even vehicle! There is an online database - AskMID.com - where you can interrogate the insurance database using the registration number to check that another vehicle is insured, but at the scene that is only available to owners of smart phones. And what do you do if it turns out they aren't - arrest them?

The DVLA has also announced that "Motorists will no longer need motor insurance policies to be checked when getting their vehicle tax.". Presumably this affects those that renew their road tax at a Post Office, as those doing it online have it checked automatically as part of that process anyway. The implication is that Post Offices will issue tax discs (for the time being) regardless of whether you have insurance or not, as the DVLA makes regular checks of the insurance database that taxed vehicles do have insurance at that time.

Another change is an improvement to SORN, once declared it doesn't have to be renewed annually, it remains in force until the vehicle is taxed or sold.

March 2013

A rare bit of good news (apart from a penny off beer). After the Conservative Government introducing the rolling exemption from Road Tax for classic cars more than 25 years old, one of the first acts of Gordon Brown and Labour was to freeze it at 1st January 1973, i.e. cars built before that date were exempt. Quite out of the blue, considering this is a time of austerity, George Osborne announced in the Budget that from 1st April 2014 it would be extended by one year, to vehicles built before 1st January 1974. Vee has got another two years to go, being built in May 1975. Will the Conservatives have to time to extend it further before the next Labour Government? I'll not be holding my breath! June 2011

Just renewed the ZS MOT, and see there is an MOT Text Reminder service now available. From Top Gear - this How Many Left? website using DVLA data. Note the MGB is found under 'MG B', and the MG Montego under that description whereas the Maestro and Metro are found under 'MG'. Also note that the model list pages shows only licensed vehicles, you have to click on the model name to see the additional number SORNed (Statutory Off Road Notification) in any quarter. A slight decline in roadsters taxed (figures don't include cars off the road before 1994) but the numbers did go up quite a bit around 1999. Significant and steady decline in GT numbers, and even V8 GT numbers. V8 conversions of 4-cylinder cars shouldn't be included in this but should be an engine change to the original entry, but there are 20 appearing as first registered outside the normal GT V8 production period (some of those are outside the whole of the MGB production period) and no less than 581 MGB roadsters with first registration dates after 1982! Generally speaking the older the model (of MG) the flatter the curve i.e. less scrapped, which is probably to be expected.

November 2010

A pal is in the position of having to have his screen replaced, and his MOT has just expired, on a car that is not on SORN, which raises two issues. The first is that the MOT has already expired but the car is not SORNed, the second is having to get the screen replaced before it can get an MOT. Originally he had booked it in for a home replacement, but they called him back saying a 'specialist' replacement such as this had to be done at the depot. Of course it is illegal to use a car on a public road without tax, insurance and MOT, or even keep it on a public road. You can drive it to an MOT testing station for a pre-booked test without road tax, but you must have valid insurance. If you drive it under any other circumstances and have an accident the insurance company are quite likely to invalidate it and you will be personally liable for any damage to third-parties as well as to your own vehicle, as well as official penalties. If the tax or insurance expires without you declaring SORN then you are automatically liable for a fine and penalty points, even if the car has not been used on the road. However the DVLA say they only scan the database once per month for these so depending on the dates of expiry and scan you could have anything from 30 days to nothing of 'grace' in order to put in a SORN. However if your registration is picked up by any ANPR equipment e.g. speed camera or roadside road tax check it will be flagged up immediately and you are more than likely to be hit with the penalties as these are generated automatically. As far as the MOT goes opinion (and it is only opinion) is that MOT expiry won't automatically generate a fine and penalty points, but the expiry date will have been recorded on the DVLA database and again ANPR equipment will flag it up. All this counsels caution in driving it to a workshop repair before driving it to an MOT station, although if the former is local you would be unlucky to get caught. To be honest even towing it could be risky, if your car is an innocent party in any incident it will come to light, trailering would be the only sure and safe way - but cover or remove the number plates or ANPR will still get you! "What about 2 wheels on a dolly and two on the road?" you may well ask. Probably OK, but it is an even greyer part of a grey area. With any of them any brief infringement may only result in a warning if it is a case of taking your documents to a Police station and you have corrected the omission in the meantime. I have seen a claim that MOT expiry will definitely go unnoticed as MOTs are administered by VOSA and the rest by the DVLA. But that is nonsense, insurance is administered by private companies and that goes onto the DVLA database, so it's pretty foolish to think VOSA data doesn't. November 2009

Not sure when this came in but if your vehicle tax is due to expire when going abroad you can renew up to two months in advance at some Post Office branches or by post to the DVLA. Other than that you can renew from the fifth day of the preceding month if the car is already taxed, or three days before the end of the month if not. April 2009

Similar to the DVLA online Vehicle Enquiry facility for registration status, I've just found this MOTINFO page that will give you the MOT history of a vehicle since computerisation started in around 2007. You need the V5C reference number, or an MOT Test Number from the VT20 Test Certificate, or the number from a VT30 failure notice. This means that strictly speaking only the owner, or someone considering purchasing the vehicle can check the MOT status and history, unlike the current registration status where you only need the registration number. February 2009As clever as I was renewing for six months last time instead of 12 with the intention of getting 11 months at the old rate after the new much higher rates come into force, I haven't had the benefit yet as the increases have been delayed. But I've also been caught by a gap in the system concerning insurance renewal which prevents me renewing it either online or by phone if I keep taxing it for 12 months. November 2008 No.2Because my insurance expires on Feb 24th the DVLA system won't let me renew the road tax (which expires on Feb 28th) until the insurance has been renewed. Fair enough you may think, but the renewal isn't notified to the DVLA by the insurance industry until the renewal comes into force no matter how far in advance you renew it. This means there is only 3 or 4 working days for the notification to get to the DVLA, to apply for the new disc, and to receive it via the post. This can take up to five days so I could quite easily end up not having received to disc by 1st March. The DVLA blame the insurance industry for this situation, and say they are looking into it, but I'm not holding my breath. I suppose I'm going to have to wait until the tax rates do go up, renew for 12 months, then renew the next time for 6 months, and hopefully avoid the situation after that. But knowing my luck our illustrious Chancellor will change the effective date of the new higher rates from April to October and I would have been better off leaving it as it was! In the meantime it is back to driving to a Post Office (one that still does it) and queuing.

The new 13-band Road Tax/VED system will be introduced in April 2009, but the increase for any car will be limited to £5. In 2010 the increase will be limited to £30, but the trade-off is that anyone buying a low-polluting vehicle will only benefit from a similar £30 reduction. But gird your loins for a massive increase (in every other form of taxation as well as VED) when the Government considers the recession is under control. November 2008 No.1Current issue of the AA magazine says: "The Treasury has said, but not officially confirmed, that cars emitting over 226 CO2/km but bought before the 2006 budget will move into Band K in 2009/10 - and will continue to benefit from a reduced rate (sic!), and only in 2010/11 will these cars be placed into the band that corresponds to the cars actual CO2 emissions." So a bit of respite being £300 for a ZS180 for the 2009/10 budget year rather than going straight up to £415, but where the AA gets its "continue to benefit from a reduced rate" from I don't know! September 2008Subsequent speculation is that all of the increase will be postponed for at least a year as part of the regeneration package.

The purchase of number plates in Northern Ireland and Scotland must now be accompanied by evidence of ownership and identity, same as in England and Wales, it's only taken them six years to catch up! But you can still get plates from outside the UK, for show purposes only of course ... August 2008A rare improvement in service to the customer? Those renewing their Road Tax from 1st September 2008 can now do so from the fifth day of the preceding month, rather than waiting until the 15th day as before. Of benefit to people on holiday - for a couple of weeks anyway. Note those retaxing after a break can still only do so two days before the end of the preceding month. April 2008Punitive car tax increases from 2009 for anything emitting over about 170 gm/km of CO2. Not only that, but it's being applied retrospectively to all cars registered since 2001 when CO2 grading was introduced. Middle of the road (ho ho) family cars are going to be hardest hit in terms of numbers and cost/performance terms - like a 2001 1400cc Astra graded at 173 gm/km! My ZS finds itself in the top-most band but one (by 2 grams!) but anyone driving a Lamborghini, Ferrari, Aston Martin, Bentley of even a Hummer will only pay £25 more! This is all about revenue, not about environment. This is going to hit the resale values of a huge number of cars, and as for most people that goes a long way towards the purchase price of a replacement I suspect that many won't be able to afford a newer more ecological car anyway, but will be forced to buy something earlier than 2001. Either that, or there will be a sudden increase in theft and burning of cars of a certain age. And what about insured values? Are they going to suddenly drop along with the resale value? December 2006

Yet more 'big brother', this time in the form of electronic number plates or chipped tax discs. Supposedly to fight crime (although what prevents the theft and fitting to another vehicle of your number plate with an electronic chip any more than one without I don't know) it is more likely to do with road pricing and charging you according to when and where you drive. April 2005

An online DVLA service is available if you want to apply for a tax disc, declare SORN, see if your old MG is still on the road. This last allows you to enquire as to the current road tax/licence status of any vehicle, which also happens to allow you to check the status of any vehicle you suspect of being used unlicensed or bearing a fake licence disc. See here. Update August 2006: Note that to buy a tax disc online you must have had the new style MOT (where applicable) at some point so they can check their own database for a current certificate and they will check if the vehicle is currently insured from the Motor Insurers Information Centre database. Note also there is a £2.50 charge for paying for a tax disc by credit card, but not if you use a debit card. Go here if you want to report an unlicensed vehicle online.

February 2005

Another potential pitfall for classic owners is the Government's proposed 'Continuous Enforcement of Motor Insurance Requirements'. This will make it an offence to have a car registered but not insured unless SORN has been declared. So if you take your car off the road and cancel your insurance or let it run out without renewing, but the tax still has some time to run you run the risk of a £100 fixed penalty fine or £1000 if you ignore the fixed penalty notice. November 2004

Rumours abound that our illustrious government are proposing to charge us for the privilege of simply owning a car even if it is kept off road and has been so for many years. The charge would be an annual registration fee of £4.50 per vehicle, which as an amount you may think is neither here nor there, but once introduced there will be nothing to stop it being raised to a much higher level. The potential effect on museum and private collections doesn't bear thinking about. There is information on a petition against this at the FBHVC site but I think the chances of the government changing their minds once the policy has been considered and published as a consultation paper is slim to non-existent.

1st January 2004

Some people seem to be getting hot under the collar and paranoid about the new Car Tax Rules :- You still can't keep or use a vehicle on the road unless it is displaying a valid tax disc.

- You can still buy a tax disc up to two weeks before the start of the month if renewing without a gap or two days before if there has been a gap.

- You can still buy one up to the 15th of the month backdated to the first of the month, but you can't keep or use the vehicle on a public road in the meantime.

- If you make a SORN declaration you must renew it annually or buy a tax disc.

- You can still travel to and from an MOT station for the purposes of a pre-arranged MOT test without displaying a current tax disc i.e. if you had previously made a SORN declaration and now want to put the car back on the road or you took it off the road before 31st January 1998 and did not need to make a SORN declaration.

- You still must have valid and current insurance cover in force before taking it on the road for any purpose including getting an MOT in advance of the tax disc.

The only change is that now people who let the tax run out and don't renew it or return the SORN will be fined automatically after about four to six weeks, instead of having to be caught on the public highway as before. Unfortunately it does nothing about the hundreds of thousands of cars in daily use that are not properly registered and have no tax insurance or MOT, and as such doesn't go far enough IMO.

Owners of cars off the road since before 31st January 1998 don't have to take any action until they next tax the vehicle see above about obtaining an MOT before the tax disc.

You can declare SORN by phoning 0870 240 0010 or taking the relevant form to your local licence issuing Post Office. Don't post it to Swansea, in fact don't post it anywhere as you will have no evidence that you have done so if it gets lost.

December 2002

Three upcoming changes: From 1st January 2003 number plates can only be obtained from registered suppliers on production of the vehicle's registration document or licence reminder and a photocard driving licence, see the DVLA info. If you don't have a photocard driving licence you have to produce two other forms of identification. Intended to prevent the fitting of false plates to stolen cars, it seems much like banning law-abiding citizens from owning guns in order to prevent gun crime. Even more ridiculously it only applies to England and Wales, you can still buy number plates as before in Scotland or Northern Ireland, or anywhere else for that matter.

From 1st February 2003 you will only be able to obtain a Tax Disc from a Post Office if you present the registration document or the licence reminder, see the Post Office info. This is to prevent 'owners' of cars that have dropped below the radar of the DVLA from buying a Tax Disc. Pre-supposes that such people who probably have such a car to avoid payment of speeding fines etc. want to MOT, insure and tax the vehicle. Me? Cynical? Never!

From 7th April 2003 (why not 1st April, I wonder ...) cars that have been written off or scrapped as a result of an accident and are subsequently repaired must undergo and pass a Vehicle Identity Check before they can be returned to the road. Following that the registration document will carry a note to show the identity has been confirmed. From the same date someone wishing to sell or dispose of a car with significant unrepaired accident damage will have to return the log book to the DVLA, see the DVLA info. Again intended to prevent criminals passing off stolen cars as repaired accident damaged ones, this legislation will have an obvious effect on the buy-back and repair or sale of classics.

September 2001

A new system started in September 2001 and the format is AB 51 EFG. The first two letters indicate where in Britain the vehicle was registered the numbers will indicate the registration half-year, and the final three letters are random. The numbers '51' indicate the 2nd half of 2001. '02' will be the 1st half of 2002, '52' the 2nd half of 2002 etc. After '19' and '59' have been used for 2009 years 2010 to 2019 will use '10' and '60' to '19' and '69' etc. up to '49' and '99' for 2049. After that? Well, I don't suppose I shall be around to find out. Another change on the same date concerns the use of 'black and silver' plates instead of reflective. Up until now it has been illegal to use black and silver plates on a car registered after 31st December 1972 irrespective of when it was built. From September 2001 the cut-off changes to cars built before that date i.e. the same as for free road tax. So my 72-built, 73-registered roadster will then be eligible to wear black and silver plates instead of reflective. Well what a much needed change that is! Since my roadster has probably carried reflective plates all its life I shan't be changing.

March 1999

The UK Registration system changes again on 1st March 1999 - instead of only changing the year letter once a year on 1st August, it will now be changed twice a year on 1st March and 1st September. The reason is said to be the bulge that currently occurs on 1st August - apparently 40% of vehicles registrations in a year occur on that one day. Two things intrigue me though: The first is that there are only five usable 'year' letters left which means that a new system will have to be introduced in two and a half years anyway. And the second is that one doesn't buy a new car in March because there is still likely to be snow, ice and salt on the roads, nor September because you might as well wait until January and get the benefit of the newer year, and in January you might as well wait until March to get the kudos of the new letter! Oh well, we shall see. One of the most misunderstood parts of the UK Registration system is the so-called "two weeks grace" when the current tax disc has expired. The DVLA say you have two weeks grace, the Police say you haven't. They are both right, for they are talking about different things.

All tax discs date from the first of the month and the DVLA allows you to purchase a disc anytime from two weeks before to two weeks after the first of the month. But note that if your vehicle is not currently taxed you can only buy a new disc three days before the start of the month and not two weeks (from August 2008 you can purchase from the 5th of the preceding month if the vehicle is already registered, just three days if not).

However!

The Police are quite likely to prosecute you if your vehicle is on the public highway and not displaying a current tax disc. "It's in the post" may not always work.

You see, the DVLA are talking about their rules that relate to the purchase of a disc, whereas the Police are talking about the laws that relate to the use of a vehicle.

Tax your car online or by phone. Driving licence renewal at 70 Judging by the number of people saying they are now too old or infirm to get under their cars, this link may be helpful. Email contact points. UK Vehicle Tax rates. Free MOT Reminder service. Checking the registration details and tax and MOT status of any vehicle, all you need is the registration number. Checking the MOT history of any vehicle, all you need is the registration number and make. Rebodying an MGB. If a new BMH shell is used, and at least two components from the running gear of the original vehicle (engine, transmission, axles (both), suspension (front and back), steering gear) the rebodied vehicle will retain the original registration number. If one or none of the original components are used the vehicle will be allocated a Q plate and a new VIN. Similarly if a second-hand bodyshell is used, e.g. an American 'dry state' shell, the vehicle will again be allocated a Q-plate and a new VIN. But even with a new BMH shell and two or more of the original components you must still notify your local DVLA office of the change and they will issue the vehicle with a new VIN of the form 'SABTLO3508123001' (I wonder how many rebodied MGBs have gone through that process!). It would be tempting to think that 'SAB' was something to do with MG as Clausager says RV8s had Rover Group 'SAX' VINs and my 2004 ZS has 'SAR', but this page indicates that 'SAB' is used for all VINs issued by the DVLA. Obtaining number plates from authorised suppliers in the UK. The Highway Code. How many left? A database and search engine of statistics about cars, motorcycles and commercial vehicles registered in the United Kingdom. Data comes directly from the Department for Transport and is regularly updated.

UK (excluding detail for Northern Ireland, which has its own Driver and Vehicle Agency) Registration Plate info from 1903 to 2003, from the Chiltern Vehicle Preservation Group. Note that with 3-letter registrations prior to 2001 the 2nd and 3rd letters indicate the registration district. From September 2001 the new format uses two digits to indicate the half-year, starting with 51 in September 2001, 02 for March 2002, 52 for September 2002 and so on, which will suffice up to 00 for 2050/51. 'Q' plates were issued to kit-cars, cars built up using components from a variety of sources, or where the age was otherwise not able to be determined to allow an age-related plate to be issued.

UK (excluding detail for Northern Ireland, which has its own Driver and Vehicle Agency) Registration Plate info from 1903 to 2003, from the Chiltern Vehicle Preservation Group. Note that with 3-letter registrations prior to 2001 the 2nd and 3rd letters indicate the registration district. From September 2001 the new format uses two digits to indicate the half-year, starting with 51 in September 2001, 02 for March 2002, 52 for September 2002 and so on, which will suffice up to 00 for 2050/51. 'Q' plates were issued to kit-cars, cars built up using components from a variety of sources, or where the age was otherwise not able to be determined to allow an age-related plate to be issued.

'MG' and 'UMG' registrations on cars sold by University Motors in the period 1930-1949 from the MG Cars site

and an appendix on some specific cars with some history.

'MG' and 'UMG' registrations on cars sold by University Motors in the period 1930-1949 from the MG Cars site

and an appendix on some specific cars with some history.

Private number plates since 1988. We have over 30 years experience buying and selling private number plates & well respected, trusted dealers. We are members of all governing bodies, resellers of DVLA registrations and registered DVLA number plate suppliers.

A commercial site selling registrations and plates to various styles

also includes a search facility to determine where and when a number was issued

or if it is unissued.

A commercial site selling registrations and plates to various styles

also includes a search facility to determine where and when a number was issued

or if it is unissued.

Classic and modern UK plates

National Registration plates around the world, from Wikipedia and from Olav's Plates.

National identification ovals from KingKong.

Not strictly registrations but which side of the road each country drives on and why from Tex Texin.